Frequently Asked Questions

Direct Deposit

Miscellaneous

Paycheck

The difference between regular, overtime and holiday pay are as follows:

- Regular pay – A non-exempt employee’s regular rate of pay must not be less than the highest federal minimum wage, state minimum wage or local minimum wage in effect when work is performed.

- Overtime pay – As defined by the FLSA, overtime pay is 1.5 times the employee’s regular rate of pay for each hour worked over 40 in a workweek. States may have their own overtime standards; which employers must follow.

- Holiday pay – Although not a federal requirement, some employers will offer their employees paid time off for holidays or pay them at higher rates for time worked on a holiday.

- Deductions: Wages withheld from an employee's earnings for the purpose of paying taxes, benefits and other mandatory items (e.g., garnishments) or voluntary contributions (e.g., charitable donations)

- Gross pay: Total pay before taxes and deductions

- Net pay: Take-home pay after taxes and deductions are subtracted from earnings

- Earnings: All monetary and non-monetary payments, including the value of benefits, received by an employee

- Pay stub: A summary document that demonstrates the factors – number of hours worked, the rates paid for those hours, deductions for taxes and benefits, etc. – that were used to calculate an employee’s pay for a designated period of time

In Treasury Room 10 in the E. Cullen basement. ID is required.

Location: E. Cullen Bldg

Your Payroll Administrator within the department can review your paycheck.

The check will indicate Advice = Direct Deposit or Check = Paper Check. The check number for Paper checks begin with the #3 and Advices begin with check # 1.

Exempt/Monthly employees (salary) are paid the first working day of the following month. For example, time worked in January is paid the first working day of February.

Non-Exempt/Biweekly (hourly) employees are paid every other week (10 days after the pay period end date). Please refer to the Payroll calendar for pay dates.

If an hourly employee physically worked over 40 hours in a full FLSA work week, then the employee is entitled to overtime. The University of Houston’s work week is from Wednesday to Tuesday.

Here’s a simple example on how overtime is calculated:

Employee is paid $10.00 hourly rate and physically worked 45 hours in a full FLSA work week. The employee is entitled to 5 hours of overtime pay at time and a half. This is how the payment is paid:

| 40 regular hours X $10.00 per hour | $400 |

| 5 OT hours X $10.00 X 1.5 | $75.00 |

| Gross Pay | $475.00 |

You would have access to your paystubs by:

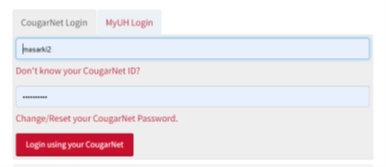

- Logging in to AccessUH.

- Choose the PASS icon

- Once you are in PASS, choose Payroll & Compensation

- Choose the paystub you would like to review the details for. You can choose by selecting the pay period.

Tax

Foreign Nationals are required to complete the certification process in Foreign National Information System (FNIS) each year to receive treaty benefits including student FICA exemptions (if their country has a treaty with the U.S.). Visit Foreign National Process for more information.

Log into PASS and select Employee Self Service

Click on Payroll & Compensation Tile

Click on W-4 Tax Information

Follow instructions to complete information