|

New mileage reimbursement rate went into effect Jan. 1

The Internal Revenue Service periodically updates the maximum mileage rate that employers can reimburse employees for business-related use of their own personal vehicle. The IRS recently announced that the rate will be decreased to 56 cents per mile starting Jan. 1, 2014.

Please note that the mileage rate used for reimbursement is based on when the mileage was incurred, not when it is reimbursed. Therefore, mileage incurred in 2013 that is reimbursed in 2014 will be reimbursed at the 2013 rate of 56.5 cents per mile.

The Mileage Report that may be used to document local, intercity mileage, parking, and tolls is located on the AP travel website (https://www.uh.edu/finance/pages/AP_Travel.htm). The driver must provide a point-to-point itemization of locations driven, the business purpose, and support the miles claimed with odometer readings or an Internet mileage calculator (e.g., Mapquest).

If you have any questions about the mileage rate, please contact Samantha Yurus (3-8721 or shyurus@central.uh.edu).

New Non-Taxable Mileage Rate for Moving Expenses

(Effective Jan. 1, 2014)

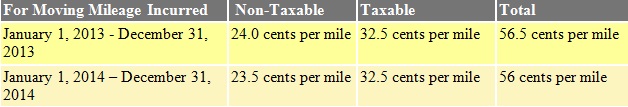

The IRS also made a change to mileage related to moving and relocation expenses effective Jan. 1, 2014. Part of the mileage associated with moving expenses is non-taxable and part is taxable. The table below indicates the taxable and non-taxable mileage rates related to moving expenses. For the calendar year 2014, non-taxable mileage rate will be decreased to 23.5 cents per mile:

If you have any questions about moving expenses, please contact Keith Gernold (3-8710 or kgernold@central.uh.edu).

|