FAQs

Domestic Travel FAQs

How is Travel Primarily for Business Purposes versus Travel Primarily for Personal Purposes calculated for domestic travel?

- The number of business days must exceed the number of personal days for travel to be considered to be primarily for business purposes.

- If the number of business days is equal to or less than the number of personal days, travel is considered to be primarily for personal purposes.

Examples

*Traveler spent 5 business days and 4 personal days – the travel is considered primarily for business.

*Traveler spent 5 business days and 5 personal days – the travel is considered primarily for personal.

*Traveler spent 4 business days and 5 personal days – the travel is considered primarily for personal.

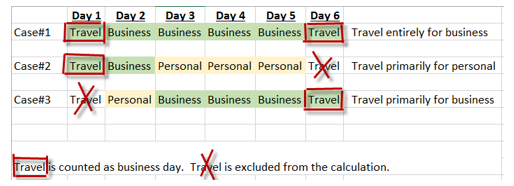

What days count as business days for domestic travel?

- Days spent primarily on business activities

- Days where the traveler was required to be in that location on that date for a business purpose

- Travel days to and from the business destination contiguous to a business day where the overnight stay is reasonable and necessary. Non-contiguous travel days are not included in the calculation.

Examples

*** Travel Day is given only when an overnight stay is necessary and reasonable.

How do you define necessity for an overnight stay?

- Travel must be outside of the tax home

- Travel on a day other than a business day is necessary if travel could not be reasonably conducted on the business day.

- Traveler must provide explanation unless the travel on a non-business day is self- evident.

Example of overnight stay that is self-evident:

The traveler was required to conduct business activities which ended 9:00PM in Chicago. In such case, an overnight stay is considered clearly necessary (self-evident).

If the travel on a non-business day is not self-evident, the traveler needs to complete the Travel Justification Form( https://www.uh.edu/office-of-finance/ap-travel/forms/) to justify travel before or after the event and attach the form to the Concur Expense Report.

Do travel days have to be immediately after the business activity for travel expenses to be eligible for reimbursement?

- No, so long as travel business days are equal to or greater than personal days.

- Travel days that are not contiguous to business days are not included in the calculation of travel days versus personal days. See page 1: What days count as business days for domestic travel?

What can be reimbursed for travel primary for business purpose?

- Cost of transportation to and from the business destination, at lowest cost

- Actual Meals during business days and necessary travel days.

- Hotel costs for business days (note – hotel costs are associated with the night before; i.e., if the conference is all day Monday and ends in the late afternoon on Tuesday, in most cases hotel for Sunday and Monday would be reimbursable)

- Incidentals, tips, and other business expenses that are ordinary and necessary

- No costs will be reimbursed for travel days that are not contiguous to a business day, other than the cost of transportation directly back to Houston.

What can be reimbursed for travel primarily for personal purposes?

- Business expenses incurred during the trip that are directly related to the business. For example, a conference registration and hotel costs during the conference only.

How are meal costs reimbursed?

- The University does not have a per diem.

- Actual meal costs are required to be claimed.

- Receipts are not required for actual meal costs up to the Federal daily meals and incidental rate

- Receipts are required for actual meal costs that exceed the Federal daily meals and incidental rate as long as the costs are within the daily caps for that destination.

- Costs cannot be averaged across days of travel.

- Receipts or a written explanation from the traveler will be requested if meal costs claimed indicate that actual costs may not have been submitted. This includes instances when meal costs are identical to the federal meal and incidental rate, and when meal costs do not fluctuate for different days of travel. The explanation must come from the traveler.

Example

An employee traveled to San Francisco to attend various meetings for three days. She did not submit receipts for the actual meals, but claimed $ 74 (Federal daily meals and incidental rate for San Francisco) per day throughout her travel as her meal expenses. In such case, the employee (not the business office) must provide an explanation. For instance, she may state “My actual meal expenses were $95.50 (1st day), $83.35 (2nd day), and $75.00 (3rd day). I did not maintain all receipts, so I am claiming $74 per day for those 3 days.”

Can luxury vehicles be rented?

- In some cases, vehicles defined as “luxury” (four-wheel drive SUVs, sports cars, town cars, limousines) may be necessary for the business purpose.

- Departmental business personnel are best placed to determine whether such rentals constitute a valid business purpose for the travel.

- Sports utility vehicles and vans are allowed when there are 3 or more business travelers in the party.

- Travelers are encouraged to use state contracted vendors for vehicle rentals since their rate include liability and loss/damage waiver (LDW) insurance in the base rate. While non-contracted rental car company is used, it is the traveler’s responsibility to obtain the proper insurance coverage.

- All Travel Expense reports containing luxury vehicle rentals will be returned to the department for an explanation of the business purpose or necessity.

Are costs associated with airfare upgrades allowable?

- Traveler is allowed to book economy class airfare with added services such as extra legroom, early-bird check in, seat selection and additional luggage, no justification is needed when reimburse these expenses. Seat upgrade with fees is not allowed.

Do conference hotel rates have to be published in the conference announcement to be allowable even if they exceed the standard travel rate?

- If the combination of conference hotel rate and meal expense exceed University daily limit, traveler should present conference brochure.

- If conference brochure is not available, VP approval is required.

How is mileage calculated for mileage reimbursements?

- Concur will calculate mileage for you based on the starting and ending point.

- For non-overnight travel, standard mileage rates have been developed for common destinations (other System campuses, frequently traveled to Texas cities). These rates can be used on the mileage reimbursement form with no other documentation of distance (see https://uh.edu/office-of-finance/ap-travel/general/recent-changes/ (https://uh.edu/office-of-finance/ap-travel/general/recent-changes/)).

What kind of expense is considered as “lavish” or “extravagant”?

- Hotel: Resort hotel (except for conference) and/or suites, room upgrade

- Meal: 200% of GSA rate

- Car rental: SUVs or vans for less than three business travelers, sports car, limousines.

- Any upgrades other than additional charges for airfare and rental car for three or more travelers, for example train ticket

Documentation Requirements

- Approved Travel Request is required in traveler’s profile before travel begins.

- A completed roster is required for documentation for group travel

- A completed Travel Justification Form(https://uh.edu/office-of-finance/ap-travel/forms/travel-justification-form.pdf) is required for claiming meal reimbursements at federal M&IE throughout the trip, late submittal of expense report, travel before Travel Request is fully approved ( local fund only ) and other reasons.

Sources MAPP 04.02.01B; UH Office of Finance references; MAPP 04.02.01A; MAPP 02.02.05; MAPP 04.02.04; IRS Publication 463; Texas Government Code Chapter 660